Monday, December 3, 2018

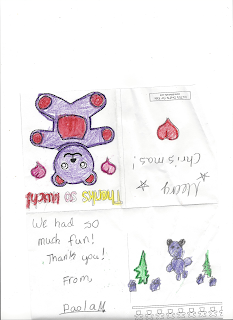

It Really was the BEST Day of the Year!

The Holiday Party for the Kids was Amazing and Only Possible Because of Generous Donors, Supportive Sponsors and Dedicated Volunteers!

Simone Charitable Foundation

A Huge Thank You to the Simone Charitable Foundation, We are Extremely Grateful!

Tuesday, November 27, 2018

Best Day of the YEAR!

Holiday Party for the Children

Saturday, December 1, 2018 at Aunt Chiladas

7330 N. Dreamy Draw Drive

Phoenix, AZ 85020

If you want to Volunteer be there by 9am

Monday, October 29, 2018

Have We Said How Much We LOVE WALMART!

Have We Said How Much We LOVE WALMART!

Phil Barber General Manager at Walmart Store 3241 Donated This 55 Inch Smart TV and Sony Sound Bar for the Make a Difference Raffle

Walmart General Manager Joseph Malinconico at Store #3896 Donated a 55 Inch Sanyo for the Make a Difference Raffle

We Can Not Thank You Enough for Your Continuing Support!

More Make a Raffle Items!

Thank You Lorin and Malcom at Inventory Adjusters for Donating these Amazing Watches for the Make a Difference Raffle! Your Generosity is Very Much Appreciated!

Monday, October 8, 2018

Buy Your Chance to Win!

Help Valley Families in Need, Call Terri at 602.332.9601 to Buy Your Make a Difference Raffle Tickets Today! Here are Just a Few of the Prizes We Will be Drawing for on November 24, 2018 and Remember you do not Need to be Present to Win

Kate Spade Purse and Wallet

Ladies Ambrose Movado Watch

Kate Spade Travel Set

Invicta Excursion

Friday, September 14, 2018

"Make a Difference Raffle and Cocktail Party"

We Are Very Excited to Announce the "Make a Difference Raffle

and Cocktail Party" Benefiting the McKenna Youth Foundation Holiday Party

and Bike Give Away for the Children. Prizes are Valued from $200.00 to $5000.00

and Winners Need Not Be Present to be Eligible. A $25.00 Ticket is Not Only

Your Chance to Win, it Also Includes Entrance into the Make a Difference

Cocktail Party Being Held at Aunt Chiladas Squaw Peak on Saturday, November 24,

2018 at 6pm. Food, Entertainment, Drink Specials, Auction and Drawings. The

More Tickets You Buy the Cheaper the Tickets and Odds Are Better You Will Go

Home with a Prize. Do Not Miss This Chance

to Make a Difference in a Child's Life and Have a Fabulous Time Doing So! Here

are Just a Few of the Prizes Being Raffled, Ladies and Gentlemen's Movado and

Invicta Watches, Kate Spade Purse and Accessory Packages, Giclee by Famous

Artist Victor Ostrovsky, a Week Stay in Florida, Disney Park Hopper Tickets,

Monte Blanc Pen and Case. Remember There are Many More Prizes We Will Be Giving

Away! Call Terri at 602.332.9601 to Get Your Winning Ticket Today and Reserve

Your Spot at the Party

1 Ticket $25.00 5 Tickets $100.00

30 Tickets $500.00

70 Tickets $1000.00

160 Tickets $2000.00

220 Tickets $2500.00

Tuesday, August 21, 2018

Tuesday, March 27, 2018

Monday, March 26, 2018

IT IS NOT TO LATE!

There is still time to make your Tax Credit Contribution for 2017, last day is April 15, 2018

Mail 29645 N. 45th Street, Cave Creek, AZ 85331 (new address)

Email mckennayouth@q.com

Fax 480.855.9971

Phone 602.332.9601

Remember you get 100% back from the State of Arizona and you can Make A Difference in a Child's Life!

Wednesday, March 14, 2018

Wednesday, February 28, 2018

Saturday, February 17, 2018

Sunday, January 28, 2018

Remember you have until 4-15-18 to make your tax contribution for 2017

How does the Arizona Tax Credit Work?

Contribute to the McKenna Youth Foundation and receive a

dollar for dollar return. Here is how it works!

The Arizona State Tax Credit program allows you to make a donation to the

McKenna Youth Foundation (Qualifying Charity Organization)as well as other types

of Arizona tax credits (Military, Foster, Public and Private Schools)and

receive a dollar-for-dollar credit against Arizona state taxes owed. This

donation counts as a charitable contributions and may be deducted on your

federal return if you itemize your deductions.

Donating to tax credit eligible organizations will most likely leave you in a

tax neutral situation – meaning you’ll pay about the same total amount whether

you use the tax credits or just pay the tax. But by donating you get a say in

how the money is spent by choosing which of the tax credit eligible

organizations you contribute to.

You can contribute up to the amount of your expected Arizona tax liability. If

you contribute more than your total state tax amount, the credits can be carried

forward five years, so not to worry if you end up with more credits than taxes.

In general, you must make your tax credit donations by April 15, 2018, in order

for them to apply to the 2017 year. You can find additional information on the

Arizona Dept of Revenue state tax credit page.

The McKenna Youth Foundation is a Arizona Credit for Donations Made to

Qualifying Charitable Organizations (formerly know as the “Working Poor

Credit”)

Contribution amounts eligible for credit: $400 for

single filers/ $800 for joint.

How Tax Credits Work

Assume you normally pay about $3,000 in total Arizona

state taxes. This year you decide to contribute to organizations eligible for

the tax credit.

Let’s assume you make four tax credits (the Arizona Military Relief Fund Credit

for $400, the Working Poor Tax Credit for $800, the Public School Tax Credit for $400

and the Private School Credit for $1,092) for a total of $2,692.

You get a dollar-for-dollar credit against state taxes owed for $2,692. By donating to tax credit eligible organizations,

now your total state tax liability equals $3,000 less

the credit of $2,692, for $308

of remaining tax liability. Your total dollars paid remains $3,000

whether you use tax credits or not – it’s either $3,000

all paid to the state, or $2,692 paid to tax credit

eligible organizations and $308 paid to the state. If

you had already paid in the full $3,000 in state taxes

during the year, you would get a refund for the $2,692.

If you itemize your deductions, you also get to take a federal deduction as a

contribution to a charitable organization for $2,692.

This saves you $673 in federal tax at the 25% rate, or

$403 at the 15% rate. (Note: if you had paid the state

tax of $2,692 rather than contributing to the tax

credit programs, the $2,692 would be part of your

itemized deductions anyway as state taxes paid qualify as an itemized

deduction, so this deduction may not be in excess of what you would get

anyway.)

Your tax professional can answer additional questions about tax credits and the

forms you need to file with your tax return to get the credit.

Please make a Tax Credit Contribution to the McKenna Youth Foundation and MAKE

A DIFFERENCE IN A CHILD'S LIFE!

Wednesday, January 10, 2018

Big Thank You!

Thank you Jam Sani for your beautiful pictures and support, we appreciate all you do!https://www.theknot.com/.../jam-sani-photography-chandler-az-1030269

Subscribe to:

Comments (Atom)